20+ Pay Calculator Indiana

If you make 70000 a year living in the region of Indiana USA you will be taxed 10616. Once done the result will be your estimated take-home pay.

Reading The 880 Page Stimulus Package Here S What I Learned Bar Restaurant

Web The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan.

. Web The Federal Minimum Wage rate and the Indian State Minimum Wage rate is the same 725 for covered no-exempted employees. Web Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Indiana. A state standard deduction exists in the form of a personal exemption.

Web The Indiana Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2023. The Cash Minimum wage rate for the Tipped. Web Salary Paycheck Calculator Indiana Paycheck Calculator Use ADPs Indiana Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Web P the principal amount. Web Indiana Taxes range from 323 and county taxes range from 05 to 2864. Web Welcome to the Salary Calculator - UK New.

SUTA runs from 05 and. Your lender likely lists interest rates as an annual figure so youll need to divide by 12 for each month of the year. The Salary Calculator has been updated with the latest tax rates which take effect from April 2023.

There are reciprocal agreements for the five states you need to know. I your monthly interest rate. See payroll calculation FAQs below.

The latest budget information from April 2022. Web Indiana Income Tax Calculator 2021. That means that your net pay will be 44148 per year or 3679 per month.

Updated for April 2023. Web 185 rows Indianans pay a flat income tax rate of 323 plus local income. Web Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Indiana.

Web Indiana calculates state taxes based on a percentage of Federal Taxable Income. Indiana applies 323 against your State Taxable income of -98000 Federal Tax Calculation for. So if your.

Web Indiana Income Tax Brackets and Other Information. Switch to Indiana salary calculator. Web Calculate your Indiana net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free.

Web Use this Indiana gross pay calculator to gross up wages based on net pay. Well do the math for youall you. Your average tax rate is 1198 and your.

Web Simply follow the pre-filled calculator for Indiana and identify your withholdings allowances and filing status. For example if an employee receives 500 in take-home pay this calculator can be used to calculate. Simply enter their federal and state W-4.

The state income tax rate in Indiana is a flat rate of 323. Web This Indiana hourly paycheck calculator is perfect for those who are paid on an hourly basis. Web If you make 55000 a year living in the region of Indiana USA you will be taxed 10852.

Senate Oks Bill Adding 310b To Paycheck Protection Program Hotel Management

Interest Rates At Kp Continue Rising Decreasing Lump Sum Payments

Top 20 Best Apps For College Students Grace College

Seer Energy Savings Calculator For Air Conditioners

How To Create A Budget Spreadsheet With Pictures Wikihow

Average Optometrist Salary Calculator

How To Dimensionalize A Measure In Looker Google Cloud

Oregon Family Leave Act Ofla The Complete Guide For 2022 2023

5 Best Realtors In Indiana 2023 Rankings Houzeo Blog

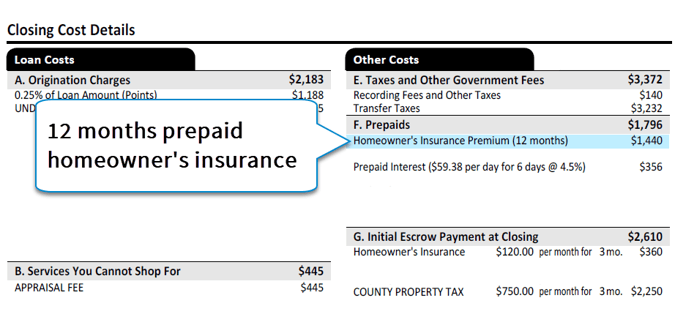

How Much Are Prepaid Items Mortgage Escrow

Indiana Paycheck Calculator Adp

Equivalent Salary Calculator By City Neil Kakkar

Gtttzen Cy12m Calculator Dual Power 12 Bit Financial Small Office Supplies Desktop Calculator

![]()

Free Indiana Payroll Calculator 2023 In Tax Rates Onpay

Indiana Income Tax Calculator Smartasset

Cash Out Refinance Find My Way Home

Top 5 Best Real Estate Investment Markets In Indiana